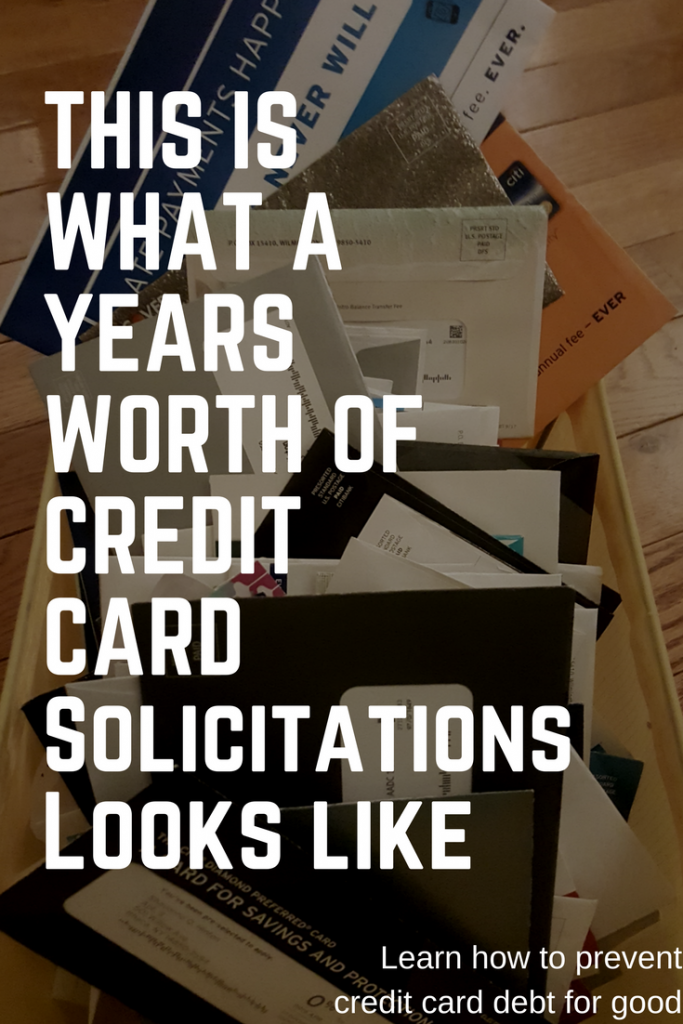

This is what a year’s worth of credit card solicitations looks like.

When I first started getting them I figured they would stop after a while. But after I got four mailings in one day, I knew it was just the beginning so I started a collection. After a year, I saved about 120 invitations to apply for a credit card. “You’ve been pre-selected to apply”, “0% Intro APR”, “Earn up to 75,000 Rewards Points”, glittery pink envelopes, shiny black ones with the word “exclusive” imprinted on them, each and every one of these offering the opportunity to start building my credit and purchase without limitation. When twice a week credit card companies are dropping opportunities for financial freedom right in your mailbox, it makes it a little bit easier to understand just how quickly you can amass a debt load you never anticipated in the first place.

I looked up statistics on credit card debt for millennials but there’s so much information it was impossible to find the right numbers. Instead, I spoke to the best audience I know, my friends and peers. Surprisingly many didn’t own credit cards, but when asked why, the most frequent response was “I have no idea which one to get”. Of the people who did have a credit card, the majority admitted to carrying a balance and being in debt.

So what’s the deal? Where is the middle ground? For those who don’t have credit cards because it’s impossible to figure out what the right one is, I GET IT! If you’re checking your snail mail daily like me, it becomes very overwhelming to decide what the right card is. Too many options can become just as confusing as no options. For the people in debt, I GET IT! Applying for a credit card is easier than ever and the rewards you can earn are too. You can go from one credit card to five in months and the debt load builds even faster.

I own two credit cards. One I applied for after graduating from college because I knew I had a ton of purchases to make. More importantly, I already had saved the money to buy everything, so I wouldn’t amass any debt. I figured getting a credit card could help me start building my credit and earn rewards too. The second one I use exclusively for work. I have never had a late payment, and I always pay the balances off in full.

While I’m proud of my financial security, by no means do I consider myself a financial guru. I’ve learned a lot in a short amount of time and no matter what your budget, these tips are applicable no matter how much debt you have or how much you earn. Here’s how you can secure the bag and maybe even have it overflowing in no time.

Unsure about what credit card to get?

Consider Chase Freedom. This was my first credit card. I never got a mailing from Chase for good reason. They’re already very well-known and established as a great starter card for people with little to no credit. I was referred by a friend to apply after they had positive reviews with using it. Chase Freedom has reward categories that rotate on a quarterly basis and sometimes you receive emails to get even more rewards. Because it’s a starter card they have a very low limit (I started out with a $2,500 limit). As you demonstrate responsible usage Chase will increase your limit, but if you don’t want it increased, it’s easy to decline.

Trying to keep your finances in order?

Download the Mint App. I was a little wary at first about connecting my financial information to the app but it’s through Intuit (also the people behind Turbo Tax and QuickBooks) so I felt confident my information would be securer than putting it into some random Android app. You can create budgets for any and everything. You can set financial goals and link up your various accounts to help make sure you’re staying on track. Each week you can see a recap of just how you spent and saved your money over the week. Mint also allows you to do a free monthly credit check. I probably check Mint just as a much as I check Instagram and it has truly changed my relationship with my money for the better.

Struggling to Manage Your Bills?

Utilize Autopay whenever possible. I use autopay for pretty much everything but my rent. Although autopay makes it easier to manage your bills, it also makes it easier to forget they exist. So each time I add a new bill, I also add a reminder on my calendar for when it’s due with the amount being deducted. It’s an easy way to remind me my money’s going to disappear but it’s also a great way to keep me actively aware of my budgeting and expenses.

For example, I purchased Spotify Premium and each month I’d get a little ping on my phone letting me know $10 is being deducted. After the fourth month, I realized I didn’t use Spotify nearly enough to justify the previous $40 I spent (that’s enough for five Chipotle burritos). So I canceled my account and found a new way to spend that money instead (thanks, Chipotle). You can reduce the stress of having to remember to pay your bills but still have active reminders of where your money is going.

Once your bills are paid do you have extra cash to spend?

Try saving it instead. One of the easiest ways to save money is to open a Certificate of Deposit (CD). My mom encouraged me to do this when I first went off to college and whenever I’ve found myself in a surplus of cash it’s usually thanks to my CD.

In a nutshell, a CD is a savings account where you agree to leave your money in the bank for a set period of time and you CAN’T remove it without a penalty until that term is up. Term lengths can vary, but they can range from months to years. The longer you agree to keep your money in, the higher the rate can be. I opened my first CD for a 12-month term. After six months went by, I opened a second CD and set that term to twelve months as well. Now, every six months I have the option to take that money back or put it back into savings. I ended up using some of the money I saved to take a trip to Europe.

Finances can be difficult to manage but they don’t have to be. These practices have given me the confidence to know that no matter how much or how little money I have, my finances will always be secure.

Definitely a really good post! I am a huge fan of treating your credit cards like a debit card and never spending more than you have on them!!!!

the best way to manage credit that could escalate quickly

great points you have made! it’s easy to get lost in credit card debt so i think it’s so important to be responsible and become aware of your finances vs. sweeping it under the rug so to speak. something i learned the hard way!

Great tips! Saving this post for future reference.

I wish so bad that someone had given me this advice years ago! I’m working now to pay off my credit cards. I wish I had never gotten one, to be honest.

when i was a lot younger i went nuts on credit card purchases. I didn’t know any better and hugely regretted it when it came time to realize I got myself into a complete mess. Now I pay them off immediately!

My first card was a Wells Fargo card simply because I banked with them and couldn’t get a card anywhere else from lack of credit. Now I regret ever getting any. I use mint and it’s really helpful. I’m slowly attempting to crawl my way out of the credit card hole I’ve dug. Great post!!

I will start soon the Chilean version of the Certificate of Deposit. I think is a great way to have extra cash and I’m good at saving money. So having a certain amount of money “stuck” doesn’t really affect me.

all great insights! I have a few posts on choosing rewards cards if you or your friends are interested! Also, CDs are great, but you should look into setting up your savings account with Ally bank! Their savings rate is like 2% almost which is better than what a lot of shorter term CDs will give you and the money is liquid!

We don’t carry over balance. We pay off our cards every month. I think so many people of all ages get into so much trouble with overspending on credit cards.

This is perfect! I am a firm advocate for healthy personal finance. I have two credit cards, one is the Chase Freedom though I rarely use it anymore. Two years ago, I opened up the Amazon Prime card which gives you cash back on all purchases to use at Amazon. I do a lot of my purchasing for home goods (like toilet paper, laundry detergent, and such essentials) on Amazon anyway so it was a great card to get. I pretty much only use it for groceries and such and use the points to get stuff on Amazon for free. I NEVER let my balance carry over to the next month. I always pay it off right away!

These are all great tips! Thanks so much for sharing!

Ash

Such great tips! Mint sounds so useful,

Credit card companies are SO GOOD at convincing you that you NEED their card! It almost NEVER ends up well! The best way to stay out of debt and utilize a card’s ‘perks’ is to pay it off every billing cycle!

Mint is my fave way to keep track of my finances too! I love having everything in a single view. Autopay definitely helps make life easier too!

This post was so helpful! I am currently a senior in college about to enter the real world and barely know anything about credit cards. Thanks for the help!